Man vs. Machine: How automation in automotive manufacturing is addressing modern labor challenges

According to reports, labor costs account for 65-70% of total manufacturing costs in the automotive sector, making it a key focus area for automakers. It comes as no surprise that plants are continually seeking to optimize the labor component of their production costs by improving workforce efficiency through automation in automotive manufacturing.

Increasingly, the automotive industry is going through a transformational period, characterized by the tectonic shift toward electric vehicles and a transition to new materials, like aluminum and composites. Coupled with downward pressures on pricing and tariff uncertainty, these shifts create significant challenges for auto producers struggling to optimize their costs and allocate resources.

While automation has always been viewed as a key to increasing the efficiency of auto manufacturing, fastening solutions in auto production still often fall short. Many automakers continue to utilize fastening systems with a significant share of manual processes while lacking resources to sustain these practices. Instead, the application of automation solutions for assembly and fully automated fastening systems has the potential to provide manufacturers with much-needed relief.

New Pressures in Automotive Manufacturing

Shift to Electric Vehicles

With the era of electric vehicles (EVs) in full swing, the automotive industry is undergoing the largest shift in its history since self-propelled vehicles replaced horse-drawn cars. As the production of EVs continues to gain momentum, it’s already clear that the industry is transitioning to new materials, advanced technologies, and different labor skill sets to meet the new demand.

Tariff Uncertainty

The changing tariff policies have created significant uncertainty in the auto industry. Tariff unpredictability has already caused major auto groups to suspend their forecasts for investors with large potential repercussions, involving changing production plans and applying cost-cutting strategies, including workforce optimization.

Pressure on Prices

While the automotive industry has returned to a demand-shaped market, the sector is still lagging behind pre-COVID levels. For example, the production outlook for light vehicles in North America has been reduced by almost one million units for 2025 and 778 ,000 in 2026, reflecting the steepest cuts since the pandemic. The lagging demand and intensifying price competition brought on by EV manufacturers exert a significant downward pressure on prices. Operating in an already low-margin industry, automotive manufacturers are pushed into actively exploring opportunities for cost-saving and efficiency.

Labor Challenges Arising from the Shifting Landscape of Automotive Production

As automakers face unprecedented pressure to cut manufacturing costs, their labor component becomes one of the key areas of concern. Meanwhile, the rising wage expectations, shortage of skilled workers, and potential layoffs in the industry require out-of-the-box thinking and the introduction of innovative technologies and processes.

Rising Wages

Wage expectations worldwide are continuing to rise, driven by the shortage of skilled workers, inflation pressures, and rising costs of living, presenting a serious challenge for cost optimization. Confronted by downward price pressure in the presence of rising wage expectations, automakers have to explore various strategies, for example, cutting hours while still offering higher pay.

Labor Shortages and Skills Gap

As experienced automotive industry workers retire, manufacturers have a hard time filling vacant roles with new, qualified labor. At the same time, the EV transition and application of new materials and technologies in the industry create additional challenges for finding and training new workers.

Potential Layoffs

Automotive OEMs and tier companies are taking drastic measures to keep pace with the price pressures and tariff uncertainty. Many auto manufacturers have already announced major layoffs throughout the EU and North America following the declining demand and growing unpredictability of the market.

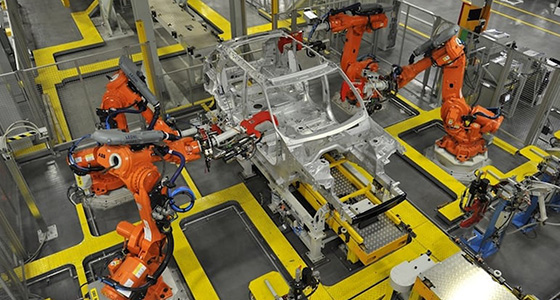

How Automation Helps Manufacturers Address Novel Labor Challenges

Faced with financial constraints, price pressures, market volatility, and industry shifts, many auto manufacturers are considering wider automation across their processes to address modern labor challenges.

Under existing conditions, the benefits of automation in automotive manufacturing can hardly be overestimated. The key advantages of introducing wider automation in manufacturing processes include:

- Cost Reduction After Initial Investment: While automation solutions in auto production require an initial investment, such an investment leads to a considerable reduction of operator hours and labor costs.

- Higher Quality of Assembly: Automation in automotive manufacturing helps increase the quality of assembly, prevent unsatisfactory installations, and avoid rework and material waste.

- Achieving Vehicle Weight Saving: The introduction of automation technology, such as automated fastening systems, allows plants to reduce the number of assemblies and weight per vehicle through better material handling and access.

- Easier Transitioning to the EV Space: Innovative technologies, such as automated fastening solutions, enable automakers to work with new materials, such as aluminum and composites, and obtain a competitive edge for transitioning into the EV space.

Stanley Engineered Fastening Solutions for Higher Efficiency

In auto production, assembly and fastening are the core processes involving thousands of riveting and welding tasks. The growing demand for automation in automotive manufacturing requires new tools and technologies that replace manual labor, ensure quicker process times, and improve the quality of fastening.

STANLEY Engineered Fastening solutions, such as Automated Blind Fastening for Rivet Nuts (ABF-N), Tucker No-Hole Stud Welding, and Tucker Self-Pierce Riveting, allow manufacturers to automate fastening and reduce operator knowledge requirements. On top of that, these solutions help achieve improved quality of fastening, better performance and ride handling for vehicles, and increased throughput.

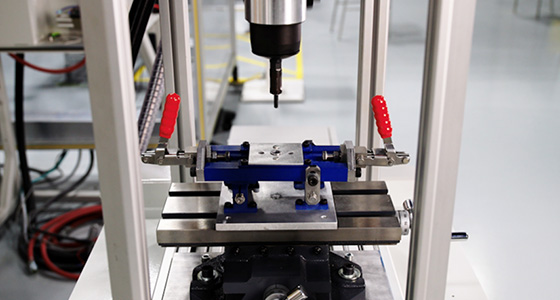

Automated Blind Fastening (ABF-N)

Automated Blind Fastening for Rivet Nuts (ABF-N) is a new technology featuring STANLEY Engineered Fastening’s latest automation innovation for blind rivet nut installation. With a process time of less than seven seconds, the ABF-N design eliminates the need for rivet nuts to be installed manually with a handheld tool, which is something automakers simply cannot afford to continue doing anymore, especially when manufacturing in the United States and Canada due to the increasingly high labor costs.

The automated process allows the network of Tucker equipment, including the blind fastening feeder, controller and head to work together, communicate, and be monitored remotely from a standardized HMI. The ABF-N technology features camera-free passive hole detection enabled by the floating front end that compensates for position deviation and angular misalignment, ensuring proper rivet insertion.

Other benefits provided by Stanley’s ABF-N technology includes:

- reduced requirements on operator knowledge

- avoiding line-down situations

- increased assembly integrity

- better access to hard-to-reach spots

- larger variation of hole positions

- lower risk of defect parts

Tucker Stud Welding

In a modern vehicle, there can be more than three hundred studs, positioned in various locations, ranging from suspension components and battery tray to the automobile body and engine compartment. Automating stud welding goes a long way toward increasing productivity and addressing labor challenges in modern automotive manufacturing.

Tucker stud welding is a no-hole technology ensuring a reliable and repeatable welding process on different materials, including steel and aluminum. Stanley’s system is an end-to-end technology, including the proprietary design fastener, the welding system, and the attachment that goes on to the stud. The system allows manufacturers to make quick changes in their production line and is utilized at facilities building over 1,000 vehicles per day.

Tucker Self-Pierce Riveting (SPR)

With increased use of aluminum in automotive manufacturing, self-pierce riveting (SPR) has become one of the most widely used methods, producing a stronger joint than the base material. Tucker’s SPR provides manufacturers with flexibility for adopting new materials and ensuring up to 10 times better repeatability in riveting applications.

The Tucker Self-Pierce Riveting system helps auto manufacturers decrease labor intensity by reducing the number of assemblies per vehicle. The technology allows ease of use and ensures higher reliability of each joint.

Conclusion

Increased automation is reshaping the automotive industry and driving performance forward. In particular, automated fastening solutions allow manufacturers to go beyond what they typically can do and increase both the quality and production throughput.

While automated fastening solutions require a certain initial investment, they can help achieve a considerable reduction in labor expenses and rework costs. Cutting dependence on operators and manual labor through automation relieves auto manufacturers of labor challenges and the current pressures in the industry and helps secure ROI and achieve production efficiency.